ZuluTrade is a popular social trading platform that allows traders to follow and copy the trading strategies of other successful traders. This article will provide an in-depth understanding of what ZuluTrade is, who it is suitable for, its benefits and drawbacks, and how to find a broker that offers ZuluTrade and open an account with them.

What is ZuluTrade?

Overview

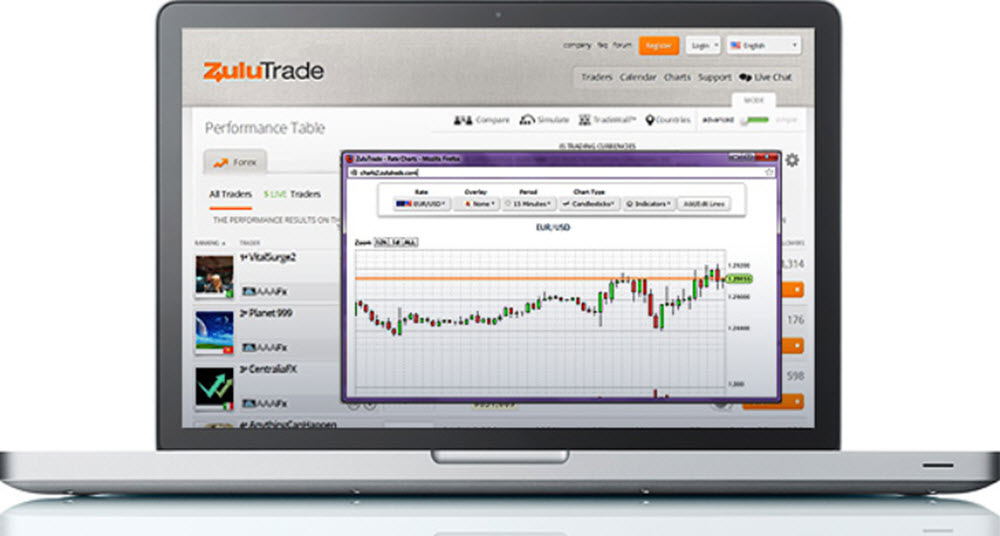

ZuluTrade is a social trading platform that enables traders to connect with and copy the trades of other successful traders, known as “Signal Providers.” Established in 2007, ZuluTrade has grown to become one of the leading social trading platforms in the industry, catering to traders worldwide and offering a wide range of financial instruments, including forex, stocks, commodities, and indices.

Who is ZuluTrade Suitable For?

Beginner Traders

ZuluTrade is an excellent choice for beginner traders who may lack the experience, knowledge, or time to develop their own trading strategies. By following and copying the trades of successful Signal Providers, newcomers can learn from experienced traders and potentially generate profits with lower risk.

Intermediate Traders

Intermediate traders can also benefit from ZuluTrade by using it as a supplementary tool to their existing trading strategies. By following multiple Signal Providers with diverse trading styles, intermediate traders can diversify their portfolios and gain exposure to different market conditions.

Investors

ZuluTrade is suitable for investors who wish to participate in the financial markets without actively managing their own trades. By allocating funds to follow Signal Providers, investors can potentially generate passive income while minimizing the time and effort required for active trading.

Benefits of ZuluTrade

Access to Successful Traders

ZuluTrade provides access to a large pool of successful Signal Providers from various countries and with diverse trading styles. This allows users to choose from a wide range of strategies, diversify their portfolios, and potentially increase their chances of success.

Customizable Risk Management

ZuluTrade offers a customizable risk management system that enables users to set their preferred risk parameters, such as maximum drawdown or maximum open trades. This allows traders to manage their risk exposure according to their individual risk appetite.

Performance Analytics

ZuluTrade’s platform provides in-depth performance analytics on Signal Providers, including their trading history, win rate, average pips per trade, and more. This information helps traders make informed decisions when selecting Signal Providers to follow.

No Coding Knowledge Required

Unlike algorithmic trading platforms that require programming knowledge to create custom strategies, ZuluTrade allows users to follow and copy trades without any coding experience. This makes the platform accessible to a wider range of users.

Drawbacks of ZuluTrade

Risk of Loss

While ZuluTrade provides access to successful traders, there is no guarantee that a Signal Provider’s past performance will continue in the future. As with any investment, following Signal Providers carries the risk of loss, and traders should carefully consider their risk tolerance before using the platform.

Performance Fees

Some Signal Providers may charge performance fees for their services, which are deducted from the profits generated by their followers. These fees can vary depending on the Signal Provider and may reduce the net returns for followers.

Limited Control

As ZuluTrade enables users to copy trades automatically, followers have limited control over their trading activity. While this can be an advantage for those who lack the time or experience to trade actively, it may not be suitable for traders who prefer to have more direct control over their trading decisions.

How to Find a Broker That Offers ZuluTrade

To use ZuluTrade, you will need to find a broker that supports the platform. Here are some tips for finding a ZuluTrade broker:

- Research online: Conduct thorough research online to identify brokers that offer ZuluTrade as a supported platform. Check broker comparison websites and forums for information about different brokers and their platforms.

- Read broker reviews: Look for reviews of brokers that offer ZuluTrade to gain insight into the experiences of other traders. This will help you understand the quality of service, trading conditions, and customer support offered by each broker.

- Check for regulation: Ensure that the broker is regulated by a reputable financial authority. This will provide you with a level of protection and assurance that the broker adheres to industry standards and practices.

- Compare fees and spreads: Assess the trading fees, commissions, and spreads offered by different ZuluTrade brokers. This will help you determine which broker offers the most competitive pricing structure.

- Evaluate customer support: Evaluate the quality of customer support provided by each broker. This can be done by contacting their support team with any questions or concerns and assessing their responsiveness and professionalism.

How to Open an Account with a ZuluTrade Broker

Once you have found a suitable ZuluTrade broker, follow these steps to open an account:

- Visit the broker’s website: Navigate to the website of your chosen broker and locate the account registration or sign-up page.

- Complete the registration form: Fill out the online registration form with your personal details, such as your name, email address, phone number, and country of residence. Some brokers may also require additional information, such as your employment status, financial situation, or trading experience.

- Verify your identity: As part of the account opening process, you will need to verify your identity by providing proof of identification (e.g., a passport or driver’s license) and proof of address (e.g., a utility bill or bank statement). This is a standard procedure for regulated brokers to comply with anti-money laundering (AML) and know your customer (KYC) regulations.

- Select your account type: Choose the type of account you wish to open. This may include options such as standard, mini, or micro accounts, each with its own set of trading conditions and requirements.

- Deposit funds: After your account has been approved, you will need to deposit funds to begin trading. Most brokers offer a variety of funding methods, including bank transfers, credit/debit cards, and e-wallets.

- Link your account to ZuluTrade: Once your account is funded, follow the instructions provided by your broker to link your trading account to the ZuluTrade platform.

- Begin trading: With your account linked to ZuluTrade, you can now begin following and copying trades from Signal Providers. Familiarize yourself with the platform’s features and tools, and carefully select Signal Providers based on their performance, trading style, and risk profile.

This article was last updated on: April 20, 2023