TradingView is a popular web-based charting and trading analysis platform that has gained widespread recognition for its powerful charting tools and social networking features. In this article, we will discuss what TradingView is, who it is suitable for, its benefits and drawbacks, and how to find a broker that offers TradingView and open an account with them.

What is TradingView?

Overview

TradingView is a web-based platform that provides advanced charting and analysis tools for traders and investors. Founded in 2011, TradingView has grown to become one of the most popular charting platforms globally, serving millions of users in more than 100 countries. The platform offers a wide range of tools and resources, including customizable charts, technical indicators, and trading signals. Additionally, TradingView features a social network that enables users to share ideas, insights, and strategies with other traders.

Who is TradingView Suitable For?

Traders and Investors

TradingView is suitable for traders and investors of all experience levels who require advanced charting and analysis tools to support their trading activities. The platform’s extensive suite of tools and resources enables users to analyze the market, identify potential trading opportunities, and execute their strategies with precision.

Technical Analysts

TradingView is an excellent choice for technical analysts who rely on chart patterns, indicators, and other technical analysis tools to inform their trading decisions. The platform offers a wide range of customizable charts and over 100 technical indicators, making it an invaluable resource for technical analysis enthusiasts.

Community-Driven Traders

TradingView’s social networking features make it an ideal platform for community-driven traders who enjoy sharing ideas, insights, and strategies with other traders. The platform’s social network allows users to follow and interact with other traders, receive trading signals, and collaborate on trading ideas.

Benefits of TradingView

Advanced Charting Tools

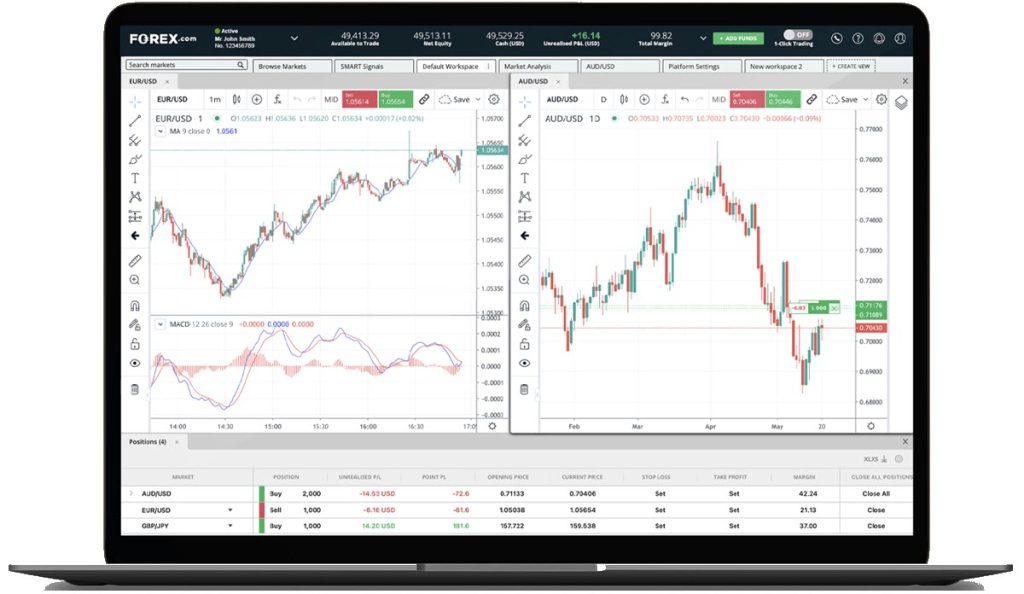

TradingView offers a comprehensive suite of advanced charting tools, including customizable charts, over 100 technical indicators, and various drawing tools. These features enable traders to analyze the market, identify potential trading opportunities, and execute their strategies with precision.

Social Networking Features

TradingView’s social network allows users to share ideas, insights, and strategies with other traders. This community-driven approach to trading can provide valuable insights, feedback, and inspiration for traders of all experience levels.

Web-Based Platform

TradingView is a web-based platform, which means that users can access it from any device with an internet connection, without the need to install any software. This makes it highly accessible and convenient for traders who require flexibility in their trading activities.

Customizable Interface

TradingView’s interface is highly customizable, allowing users to create a personalized trading environment tailored to their preferences and needs. Users can adjust chart layouts, colors, and timeframes, as well as add or remove technical indicators and other tools.

Drawbacks of TradingView

Limited Execution Capabilities

TradingView is primarily a charting and analysis platform, which means that its execution capabilities are limited compared to dedicated trading platforms. While some brokers offer integration with TradingView, users may need to use a separate platform for order execution and account management.

Subscription Costs

TradingView offers a free basic plan, but access to certain features, such as premium technical indicators, additional chart layouts, and faster data updates, requires a paid subscription. While the subscription costs are relatively affordable, they may be prohibitive for some traders.

Limited Support for Fundamental Analysis

While TradingView excels in technical analysis tools and features, its support for fundamental analysis is limited. Traders who rely heavily on fundamental analysis may need to use additional resources or platforms to conduct their research.

How to Find a Broker That Offers TradingView

TradingView has partnered with several brokers to offer integration and trading capabilities directly from the platform. To find a broker that offers TradingView, follow these steps:

- Visit the TradingView website: Go to the TradingView website and navigate to their “Brokers” page. This will provide you with a list of brokers that have partnered with TradingView and offer integration with the platform.

- Research online: Conduct additional research online to explore other brokers that might not be listed on the TradingView website but still offer integration with the platform. Check broker comparison websites, forums, and trading communities for recommendations and insights.

- Read broker reviews: Look for reviews of brokers that offer TradingView integration to gain insight into the experiences of other traders. This will help you understand the quality of service, trading conditions, and customer support provided by each broker.

- Check for regulation: Ensure that the broker is regulated by a reputable financial authority. This will provide you with a level of protection and assurance that the broker adheres to industry standards and practices.

- Compare fees and commissions: Assess the trading fees, commissions, and other costs associated with each broker that offers TradingView integration. This will help you determine which broker offers the most competitive pricing structure.

How to Open an Account with a TradingView-Compatible Broker

Once you have found a suitable broker that offers TradingView integration, follow these steps to open an account:

- Visit the broker’s website: Navigate to the website of your chosen broker and locate the account registration or sign-up page.

- Complete the registration form: Fill out the online registration form with your personal details, such as your name, email address, phone number, and country of residence. Some brokers may also require additional information, such as your employment status, financial situation, or trading experience.

- Verify your identity: As part of the account opening process, you will need to verify your identity by providing proof of identification (e.g., a passport or driver’s license) and proof of address (e.g., a utility bill or bank statement). This is a standard procedure for regulated brokers to comply with anti-money laundering (AML) and know your customer (KYC) regulations.

- Select your account type: Choose the type of account you wish to open. This may include options such as standard, professional, or institutional accounts, each with its own set of trading conditions and requirements.

- Deposit funds: After your account has been approved, you will need to deposit funds to begin trading. Most brokers offer a variety of funding methods, including bank transfers, credit/debit cards, and e-wallets.

- Integrate TradingView: Once your account is funded, follow the instructions provided by your broker to connect your trading account to the TradingView platform. This may involve configuring your API access, granting permission for TradingView to access your account, or following other steps specified by your broker.

- Begin trading: With your account linked to TradingView, you can now begin analyzing the market, sharing ideas with the community, and executing trades directly from the platform.

This article was last updated on: April 20, 2023