The foreign exchange (forex) market is the largest and most liquid financial market globally, with an average daily trading volume exceeding $6 trillion. To navigate this fast-paced market, traders require reliable and powerful trading software. This article will discuss some of the best trading software for forex trading, highlighting their features, benefits, and drawbacks.

MetaTrader 4 (MT4)

Overview

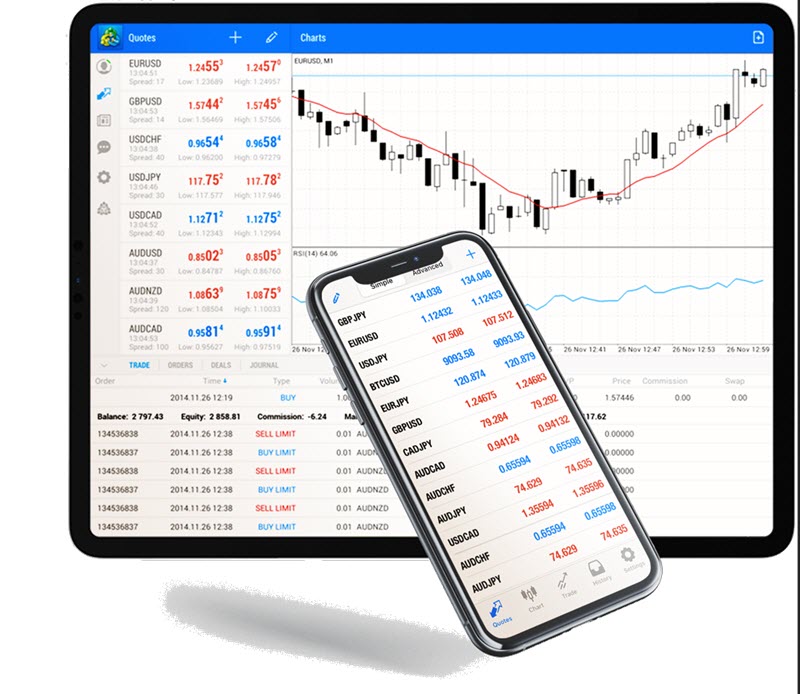

MetaTrader 4, or MT4, is one of the most popular trading platforms for forex traders worldwide. Developed by MetaQuotes Software, MT4 has been the go-to platform for forex traders for more than a decade. Its user-friendly interface, powerful charting tools, and extensive range of technical indicators have made it a favorite among both beginners and experienced traders.

Features and Benefits

- Advanced charting tools: MT4 offers a comprehensive suite of charting tools, including customizable charts, timeframes, and over 50 built-in technical indicators.

- Expert Advisors (EAs): Traders can utilize EAs, which are automated trading systems, to execute trades based on predefined strategies and market conditions.

- MQL4 programming language: MT4’s native programming language, MQL4, allows traders to create custom indicators, scripts, and EAs to enhance their trading experience.

- Wide broker support: The majority of forex brokers offer support for the MT4 platform, ensuring compatibility and ease of use for traders.

Drawbacks

- Limited asset classes: MT4 primarily focuses on forex trading, with limited support for other asset classes such as stocks, commodities, and cryptocurrencies.

- Outdated interface: Some traders may find the MT4 interface dated compared to newer trading platforms.

MetaTrader 5 (MT5)

Overview

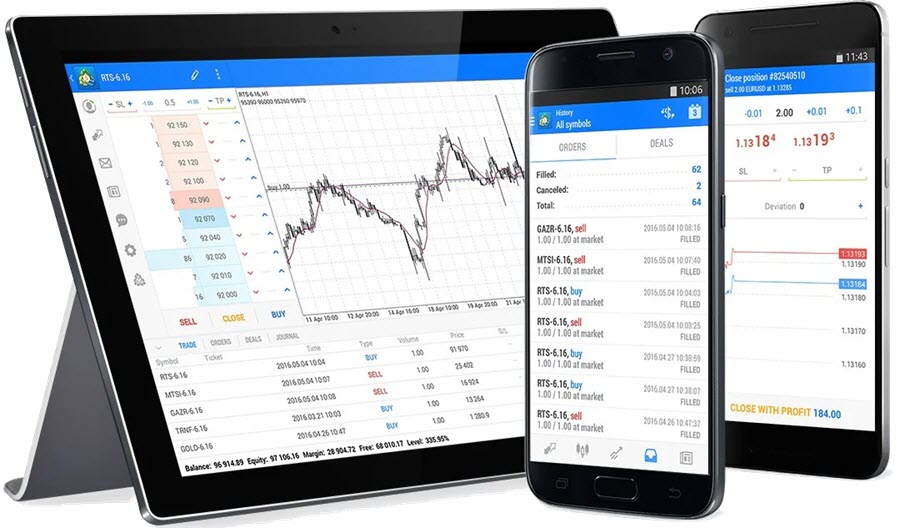

MetaTrader 5, or MT5, is the successor to MT4, offering additional features and improvements over its predecessor. Like MT4, MT5 is developed by MetaQuotes Software and has gained popularity among forex traders due to its advanced trading tools and expanded asset class support.

Features and Benefits

- Enhanced charting tools: MT5 offers improved charting tools, including more timeframes, additional technical indicators, and a wider range of drawing tools.

- Expanded asset class support: MT5 supports trading in multiple asset classes, including forex, stocks, commodities, and cryptocurrencies.

- MQL5 programming language: MT5’s native programming language, MQL5, is more advanced and versatile than MQL4, allowing traders to create more sophisticated custom indicators, scripts, and EAs.

- Market depth: MT5 provides market depth information, which can help traders gauge liquidity and make more informed trading decisions.

Drawbacks

- Limited broker support: While MT5 is gaining traction, its broker support is still not as extensive as MT4, which might limit the choice of brokers for traders.

- Not fully backward compatible: Custom indicators, scripts, and EAs developed for MT4 may not be directly compatible with MT5 and might require modifications.

cTrader

Overview

cTrader is a multi-asset trading platform developed by Spotware Systems that offers advanced trading tools, a user-friendly interface, and support for forex, stocks, commodities, and cryptocurrencies. cTrader has gained popularity among traders looking for a modern and intuitive platform with a focus on forex trading.

Features and Benefits

- Modern and intuitive interface: cTrader’s interface is sleek, modern, and user-friendly, making it an attractive choice for traders who prefer a more contemporary platform.

- Advanced charting tools: cTrader offers a wide range of advanced charting tools, including customizable charts, timeframes, and a vast array of technical indicators.

- Level II pricing: cTrader provides Level II pricing, giving traders access to market depth information that can help them make better-informed trading decisions.

- cAlgo programming language: cTrader’s native programming language, cAlgo, enables traders to create custom indicators, scripts, and automated trading strategies to enhance their trading experience.

- Cloud-based platform: cTrader stores user settings and preferences in the cloud, allowing traders to access their customized trading environment from any device with an internet connection.

Drawbacks

- Limited broker support: cTrader’s broker support is not as extensive as MT4 or MT5, which might limit the choice of brokers for traders.

- Subscription fees: Some advanced features and tools within cTrader may require a paid subscription, which could be a drawback for budget-conscious traders.

NinjaTrader

Overview

NinjaTrader is a trading platform that caters to both forex and futures traders. It is known for its advanced order management and execution features, as well as its customizable interface and support for third-party add-ons.

Features and Benefits

- Advanced order management: NinjaTrader offers advanced order management and execution tools, such as OCO orders, trailing stops, and automated trade management.

- Customizable interface: Traders can tailor NinjaTrader’s interface to their preferences, creating a personalized trading environment.

- Support for third-party add-ons: NinjaTrader supports third-party add-ons, allowing traders to expand the platform’s functionality with custom indicators, strategies, and tools.

- NinjaScript programming language: NinjaTrader’s native programming language, NinjaScript, enables traders to create custom indicators, strategies, and other trading tools to enhance their trading experience.

Drawbacks

- Limited broker support: Not all forex brokers support the NinjaTrader platform, which might limit traders’ choice of brokers.

- Fees and commissions: NinjaTrader’s advanced features and tools may come with additional fees, such as platform fees or commissions, which could be a drawback for budget-conscious traders.

Conclusion

There is no one-size-fits-all solution when it comes to trading software for forex trading. The best trading platform for you will depend on your individual preferences, trading style, and requirements. MetaTrader 4 and MetaTrader 5 remain popular choices for forex traders due to their wide broker support and powerful charting tools. However, cTrader and NinjaTrader also offer advanced features and tools that may appeal to more experienced or specialized traders. Ultimately, it’s crucial to research each platform thoroughly and try out demo accounts to determine which trading software best suits your needs.

This article was last updated on: April 20, 2023