Trading software has become an essential tool for both beginners and experienced traders alike. The right software can provide you with essential market insights, help you execute trades, and even automate your trading strategies. In this article, we will explore some of the most popular trading software options available, including MetaTrader 4, MetaTrader 5, cTrader, TradeStation, NinjaTrader, AlgoTrader, ZuluTrade, and TradingView. We will also discuss the process of developing your own custom trading software, highlighting the benefits and drawbacks of each option.

MetaTrader 4 (MT4)

Overview

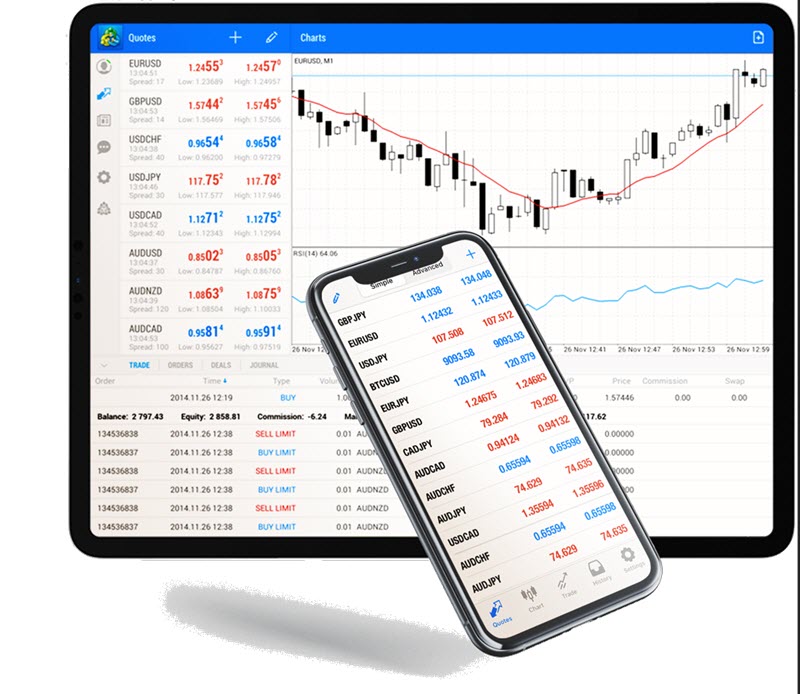

MetaTrader 4 is one of the most popular and widely-used trading platforms in the world. Developed by MetaQuotes Software Corp., this software is primarily designed for forex trading, but also supports other markets, such as commodities and indices.

Benefits

- User-friendly interface: MT4 is known for its intuitive and easy-to-use interface, making it a popular choice for beginners.

- Wide range of indicators and tools: MT4 offers a vast array of built-in technical indicators and drawing tools, allowing traders to perform in-depth market analysis.

- Expert Advisors (EAs): MT4 supports automated trading through the use of Expert Advisors, which are custom-built trading algorithms or bots.

Drawbacks

- Limited asset classes: MT4 is primarily focused on forex trading, with limited support for other asset classes.

- Outdated technology: As MT4 has been around for quite some time, some of its features and technology may be considered outdated compared to newer platforms.

MetaTrader 5 (MT5)

Overview

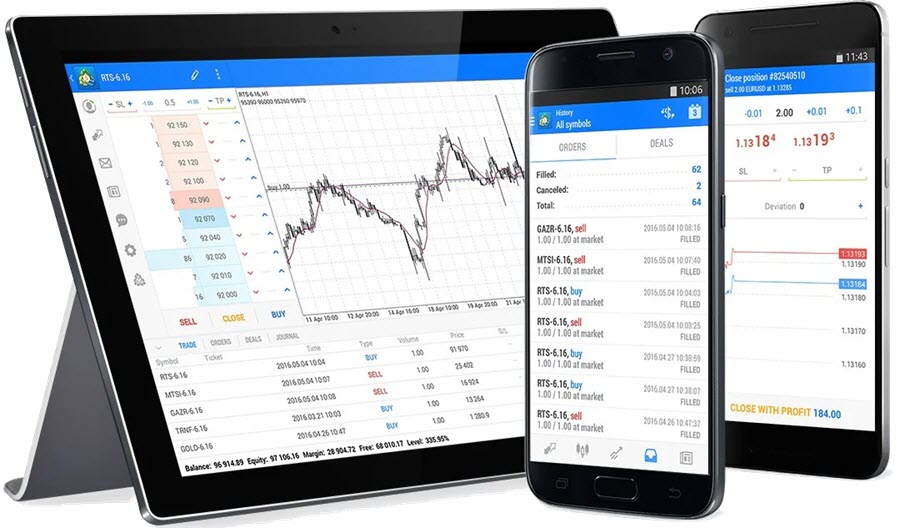

MetaTrader 5 is the successor to MetaTrader 4, offering an expanded range of features and capabilities. Like its predecessor, MT5 is developed by MetaQuotes Software Corp. and is designed for trading multiple asset classes, including forex, stocks, futures, and commodities.

Benefits

- Multi-asset trading: MT5 supports a wider range of asset classes compared to MT4, making it a more versatile trading platform.

- Advanced functionality: MT5 offers more advanced features than MT4, including an integrated economic calendar, depth of market, and improved charting capabilities.

- Improved execution speeds: MT5 is built on a more modern architecture, which enables faster order execution and better overall performance.

Drawbacks

- Less widespread adoption: MT5 is less popular than MT4, meaning that some brokers and third-party tools may not support the platform.

- Increased complexity: The additional features in MT5 may be overwhelming for beginners, leading to a steeper learning curve.

cTrader

Overview

cTrader is a trading platform developed by Spotware Systems, designed primarily for forex and CFD trading. It is known for its sleek interface and advanced features, catering to both manual and algorithmic traders.

Benefits

- Modern user interface: cTrader offers a clean and modern user interface, making it easy for traders to navigate and customize their workspace.

- Advanced order types: cTrader supports a variety of advanced order types, including stop limit, trailing stop, and OCO orders.

- Algorithmic trading: cTrader supports automated trading through cAlgo, its proprietary algorithmic trading platform.

Drawbacks

- Limited broker support: Not all forex brokers offer cTrader as a platform option, which may limit its availability to some traders.

- Resource-intensive: cTrader may consume more system resources than other platforms, potentially affecting performance on lower-end computers.

TradeStation

Overview

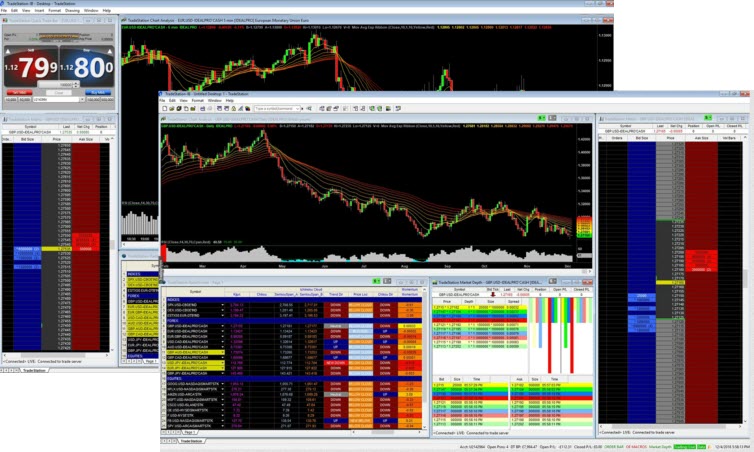

TradeStation is a comprehensive trading platform developed by TradeStation Technologies Inc., designed for trading stocks, options, futures, and forex. It is known for its advanced charting capabilities, extensive range of tools, and support for algorithmic trading.

Benefits

- Highly customizable: TradeStation offers extensive customization options, allowing traders to create their ideal trading environment.

- Advanced charting and analysis: The platform provides a wide range of charting tools, technical indicators, and drawing tools for in-depth market analysis.

- Algorithmic trading: TradeStation supports automated trading through its proprietary EasyLanguage scripting language, allowing traders to develop custom strategies and indicators.

Drawbacks

- Expensive: TradeStation’s platform and data fees can be higher than other trading software, making it less accessible for smaller traders.

- Steep learning curve: TradeStation’s advanced features and customization options may be overwhelming for beginners.

NinjaTrader

Overview

NinjaTrader is a trading platform developed by NinjaTrader LLC, designed for trading futures, forex, and stocks. It offers a range of advanced tools and features, focusing on providing a powerful trading environment for discretionary and algorithmic traders.

Benefits

- Advanced trade management: NinjaTrader offers advanced trade management features, such as automated trailing stops and profit targets, allowing traders to better manage their positions.

- Extensive add-on ecosystem: The NinjaTrader ecosystem includes a wide range of third-party add-ons, including custom indicators, strategies, and educational resources.

- Algorithmic trading: NinjaTrader supports automated trading through its proprietary NinjaScript language, which allows traders to create custom strategies and indicators.

Drawbacks

- Limited asset classes: NinjaTrader primarily supports futures, forex, and stocks, with limited support for other asset classes.

- Complexity: The advanced features and customization options in NinjaTrader may be challenging for beginners to learn and use effectively.

AlgoTrader

Overview

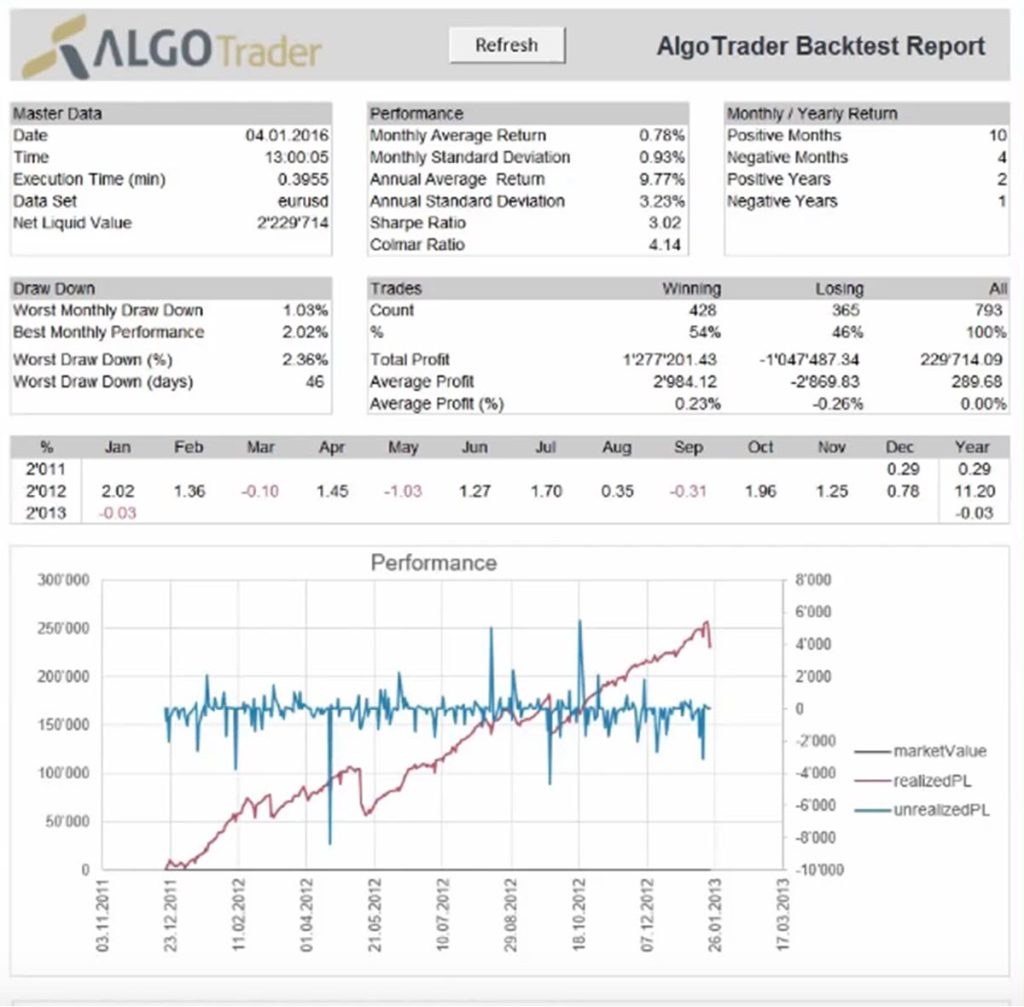

AlgoTrader is a trading platform specifically designed for algorithmic trading. It supports multiple asset classes, including equities, forex, futures, and cryptocurrencies, and offers a comprehensive suite of tools for strategy development, backtesting, and execution.

Benefits

- Focused on algorithmic trading: AlgoTrader is built specifically for algorithmic traders, offering a powerful and flexible environment for strategy development and execution.

- Wide range of supported asset classes: AlgoTrader supports a variety of asset classes, making it a versatile choice for traders interested in multiple markets.

- Integration with popular data providers: AlgoTrader integrates with popular market data providers, such as Quandl and Bloomberg, for easy access to historical and real-time data.

Drawbacks

- Limited appeal to non-algorithmic traders: AlgoTrader’s focus on algorithmic trading may make it less appealing to discretionary traders.

- Higher cost: AlgoTrader’s pricing may be prohibitive for smaller traders or those just starting with algorithmic trading.

ZuluTrade

Overview

ZuluTrade is a social trading platform that allows traders to follow and copy the trades of other successful traders, known as “signal providers.” It supports forex, indices, commodities, and cryptocurrencies.

Benefits

- Copy trading: ZuluTrade’s copy trading feature allows traders to automatically replicate the trades of successful signal providers, which can be helpful for beginners or those with limited trading experience.

- Diverse range of signal providers: The platform hosts a large number of signal providers, offering traders a wide range of trading strategies to choose from.

- Performance analytics: ZuluTrade provides in-depth performance analytics for each signal provider, helping traders decide who to follow.

Drawbacks

- Reliance on signal providers: Using ZuluTrade effectively requires reliance on the skill and performance of signal providers, which can be unpredictable.

- Risk of over-leveraging: Some signal providers may use highly leveraged strategies, which can lead to significant losses if not managed carefully.

TradingView

Overview

TradingView is a web-based trading platform and social network for traders. It offers advanced charting and analysis tools and a community-driven approach to trading ideas and strategies.

Benefits

- Accessible from any device: TradingView is web-based, which means it can be accessed from any device with an internet connection, without the need for installing software.

- Extensive charting capabilities: TradingView offers a wide range of charting tools and indicators, making it easy for traders to perform in-depth market analysis.

- Social trading: TradingView’s community-driven approach allows traders to share ideas, strategies, and insights with others, fostering collaboration and learning.

Drawbacks

- Limited order execution capabilities: TradingView primarily focuses on charting and analysis, with limited support for executing trades directly from the platform.

- Subscription-based pricing: TradingView offers a tiered subscription model, with some advanced features and tools available only to paying subscribers.

Developing Your Own Trading Software

Developing custom trading software is an option for those looking to create a completely personalized trading experience. This approach allows traders to tailor the software to their specific needs and preferences, creating a unique trading environment.

Benefits

- Customization: Developing your own trading software allows for complete control over features, tools, and functionality.

- Unique strategies: Custom software enables the implementation of unique trading strategies not found in off-the-shelf platforms.

Drawbacks

- Time and resources: Developing custom trading software requires a significant investment of time and resources, including programming skills and knowledge of trading systems.

- Maintenance and updates: Custom software requires ongoing maintenance and updates to remain effective and secure.

This article was last updated on: June 6, 2024